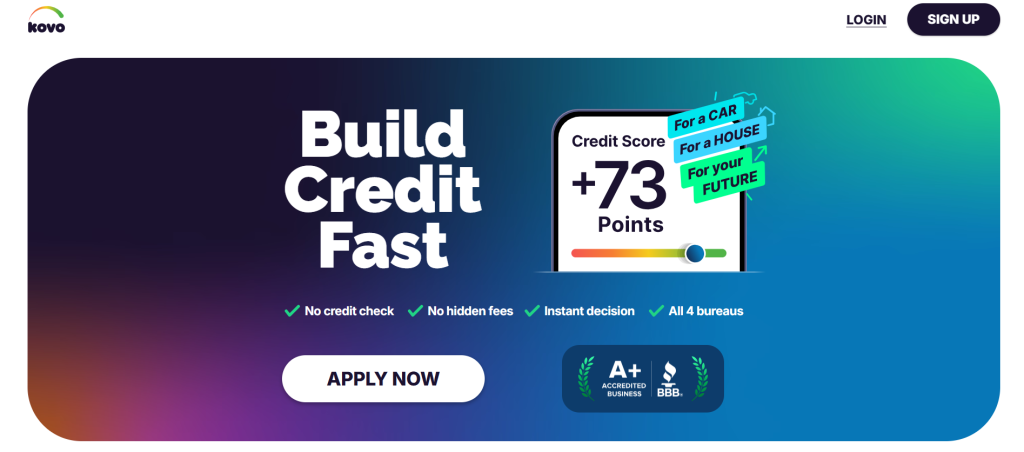

In today’s fast-paced world, managing your finances can often feel overwhelming. With so many options available, how do you find the right support to meet your unique needs? Enter Kovo Credit—a game-changer in the realm of financial services! Whether you’re looking to consolidate debt, fund a new venture, or simply gain better control over your budgeting, Kovo Credit offers tailored solutions that empower you on your financial journey. In this blog post, we’ll dive into the myriad benefits of using Kovo Credit for all your financial needs and explore how it can transform not just your credit score but also your overall financial wellbeing. Get ready to unlock a brighter future with smarter financing strategies at your fingertips!

How Does Kovo Credit Work?

Kovo Credit offers a streamlined approach to managing your financial needs. It operates as an online platform, allowing users to apply for credit quickly and conveniently. The process begins with a simple application. Users provide basic information about their financial situation and credit history. Kovo uses this data to assess eligibility promptly. Once approved, you can access funds directly through your account. The platform emphasizes transparency, clearly outlining terms before any agreement is made. Repayment options are flexible, catering to different budgets and preferences. This adaptability makes it easier for individuals to stay on track with payments. Kovo also leverages technology to enhance user experience, making account management straightforward. Notifications help keep users informed about due dates or changes in balance. This modern approach suits those looking for efficiency without the hassle of traditional banking methods.

Benefits of Using Kovo Credit for Your Financial Needs

Kovo Credit offers numerous advantages for managing your financial needs effectively. One of the standout benefits is lower interest rates compared to traditional lending options. This can save you money over time, making it easier to pay off debts. Flexible payment options are another key feature. Kovo understands that life can be unpredictable, so they allow borrowers to choose plans that fit their budgets and schedules. This flexibility helps reduce stress when repaying loans. Moreover, using Kovo Credit responsibly can lead to an improved credit score. Timely payments demonstrate reliability, which lenders appreciate. With a better credit rating, you’ll have access to more financing opportunities in the future. These benefits make Kovo Credit a compelling choice for those seeking financial solutions tailored to their unique situations while promoting long-term financial health.

Lower Interest Rates

One of the standout advantages of using Kovo Credit is its lower interest rates. Many borrowers find traditional loans burdened with hefty fees and high-interest charges. Kovo Credit prioritizes affordability, making it a smart choice for those seeking financial assistance without breaking the bank. Lower rates mean you can save money over time, allowing for better budgeting and planning. This feature makes Kovo particularly appealing to individuals who may have struggled with high-interest credit cards or personal loans in the past. By choosing Kovo, you’re not just borrowing money; you’re investing in your financial future. The transparent structure of their interest rates ensures that there are no hidden surprises down the road. This clarity helps users make informed decisions about their borrowing options.

Flexible Payment Options

Kovo Credit stands out for its flexible payment options, designed to meet individual financial situations. This adaptability helps borrowers manage their repayments without undue stress. Customers can choose from various repayment plans that align with their income cycles. Whether you prefer weekly or monthly payments, Kovo accommodates your needs. Such flexibility ensures that you won’t feel overwhelmed by looming deadlines. Additionally, Kovo allows users to make early payments without penalties. This feature is beneficial for those who may want to pay off their balance sooner and save on interest costs. Life can be unpredictable, and having the option to adjust payment schedules provides peace of mind. You can focus more on your goals rather than worrying about rigid deadlines and strict policies often found in traditional lending institutions.

Improved Credit Score

Using Kovo Credit can significantly improve your credit score over time. When you manage your payments responsibly, it reflects positively on your credit report. Kovo reports to major credit bureaus, meaning that timely payments can boost your rating. A higher score opens doors to better financial opportunities, such as lower loan rates or increased lending limits. Moreover, having a diverse mix of credit types helps enhance your profile. By incorporating Kovo into your financial strategy, you’re not just borrowing; you’re building a stronger foundation for the future. Many users find that consistent use leads to noticeable improvements in their scores within months. This positive cycle encourages smart spending and prudent budgeting habits along the way.

Tips for Managing Your Kovo Credit Account Efficiently

Managing your Kovo Credit account requires a bit of strategy. Start by setting up alerts for payment due dates. This simple step can help you avoid late fees and potential negative impacts on your credit score. Track your spending closely. Use budgeting apps to see how much you’ve charged each month. Being aware of your usage helps maintain control over your finances. Make payments frequently, even if they’re small amounts. Paying off balances ahead of schedule reduces interest accrual and enhances your credit health. Utilize the features within the Kovo platform. Take advantage of financial tools designed to help users stay organized and informed about their accounts. Lastly, review your statements regularly to catch any discrepancies early on. Staying proactive not only supports better financial habits but also builds trust with lending institutions like Kovo Credit.

Is Kovo Credit the Right Choice for You?

Kovo Credit offers a fresh approach to managing financial needs. With its focus on lower interest rates, flexible payment options, and the potential for improved credit scores, it stands out in today’s lending landscape. Many users have reported positive experiences, praising the ease of use and customer service. Compared to traditional banks and other lending institutions, Kovo Credit often provides quicker access to funds without complicated requirements. If you’re considering Kovo Credit, weigh your personal circumstances against what it has to offer. Think about your financial goals and how this option aligns with them. Your choice should reflect your unique situation and comfort level with different types of credit solutions available today.