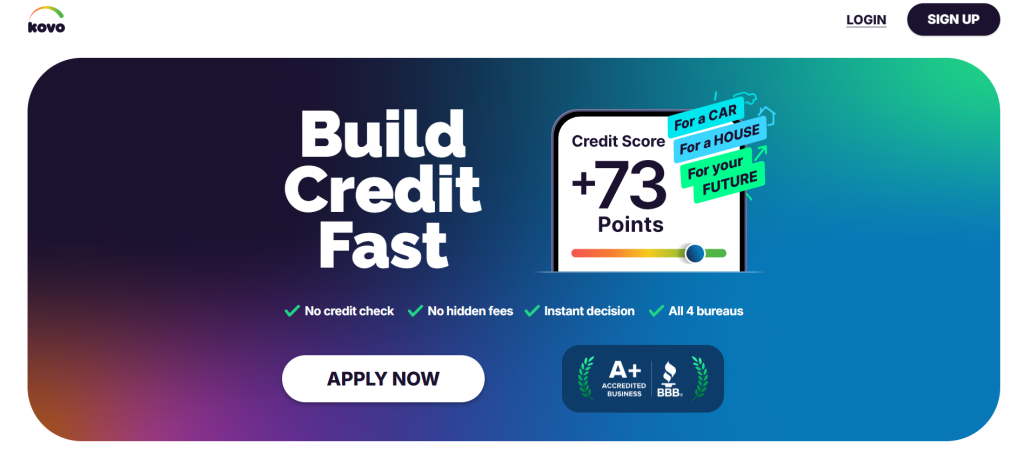

Are you tired of feeling trapped by your financial situation? Struggling with a credit score that seems impossible to improve? You’re not alone! Many people find themselves in a cycle of debt and low credit ratings, but what if we told you there’s a key to unlocking the door to financial freedom? Enter Kovo Credit—a game-changing platform designed to empower individuals on their journey towards better credit health. In this blog post, we’ll explore how Kovo Credit can transform your credit score and open up new opportunities for loans, mortgages, and even that dream vacation you’ve been putting off. Get ready to take control of your finances and step into a brighter future—your path to financial liberation starts here!

How Does Kovo Credit Work?

Kovo Credit simplifies the journey to a better credit score with its user-friendly platform. It starts by tracking and monitoring your credit report in real time. You’ll receive timely updates, so you’re always aware of where you stand. Personalized strategies are at the heart of Kovo’s approach. After analyzing your financial situation, it crafts tailored recommendations just for you. These strategies target areas needing improvement, making the path to an elevated score clearer. Additionally, Kovo provides access to various financial tools and resources designed for everyday users. From budgeting tips to understanding loan options, these resources empower you with knowledge that can lead to smarter decisions about your finances.

Tracking and monitoring credit score

Tracking your credit score is essential for understanding your financial health. With Kovo Credit, you gain access to real-time updates on how your score changes over time. No surprises—just insights. This feature allows you to identify trends and pinpoint areas that need attention. You can monitor factors like payment history, credit utilization, and new accounts affecting your score. Receiving alerts when significant changes occur keeps you informed and proactive about managing your finances. Instead of waiting for periodic checks, you’ll have a continuous pulse on where you stand. Regular monitoring helps build awareness around spending habits too. The more informed you are about what impacts your score, the better decisions you can make moving forward with confidence.

Personalized credit improvement strategies

Personalized credit improvement strategies are tailored to fit your unique financial situation. Instead of a one-size-fits-all approach, Kovo Credit analyzes your credit history and identifies specific areas for enhancement. This means you receive actionable steps designed just for you. Whether it’s reducing debt utilization or disputing inaccuracies on your report, each strategy is crafted with precision. Kovo’s technology takes into account various factors like payment history and outstanding debts to create a customized plan. This level of personalization can make all the difference in boosting your score effectively. You won’t be left guessing what to do next; every recommendation aligns with your goals. With ongoing support, adapting these strategies becomes seamless as your financial landscape changes over time.

Benefits of Using Kovo Credit:

Using Kovo Credit can significantly speed up your journey to a better credit score. With tailored strategies, you’ll see improvements sooner than expected. Another major advantage is the potential for saving on interest rates and fees. A higher credit score often results in lower borrowing costs. This means more money stays in your pocket. Additionally, Kovo Credit opens doors to improved financial opportunities. Whether it’s securing a loan or qualifying for premium credit cards, better options become available as your score rises. The tools and resources offered by Kovo empower users to make informed financial decisions. Knowledge is power when managing finances effectively. Kovo Credit isn’t just about numbers; it’s about building confidence in your financial future. Embrace the benefits that come with enhanced credit health and watch how it transforms various aspects of life.

Improve credit score faster

Improving your credit score can feel like a daunting task. However, with Kovo Credit, you have the tools to accelerate this journey. Kovo provides tailored strategies that focus on your unique financial situation. Instead of guesswork, you receive clear guidance on actionable steps to boost your score more quickly. Timely payments are crucial for raising your credit score. Kovo helps track due dates and sends reminders so you never miss a payment again. Additionally, by analyzing your existing debt levels and suggesting effective repayment plans, Kovo ensures you’re not just making progress but doing so efficiently. With features designed specifically for speed and effectiveness, users often see noticeable improvements in their scores within months rather than years.

Save money on interest rates and fees

When your credit score improves, it directly influences the interest rates you can access. Lower scores often mean higher rates, costing you more over time. With Kovo Credit, you’re on a tailored journey to boost that score. Imagine qualifying for better loan terms or credit cards with lower APRs. This isn’t just theoretical; it’s a tangible benefit of consistently monitoring and enhancing your credit profile. Reduced fees are another perk. Many financial institutions charge premiums based on risk assessment linked to your creditworthiness. As your score climbs, those extra charges start to disappear. Kovo Credit equips you with strategies designed specifically for your situation. You’ll learn how to navigate debts effectively while unlocking opportunities that save money in the long run. It’s not just about improving numbers—it’s about regaining control over your finances too.

Better financial opportunities

A strong credit score opens many doors. With Kovo Credit, users often find themselves qualifying for better loans and credit cards. This can lead to lower interest rates that save money in the long run. Imagine applying for a mortgage with a competitive rate rather than facing higher costs due to poor credit history. Accessing premium financial products becomes easier when your score improves. Additionally, improved credit scores can enhance rental applications. Landlords frequently check applicants’ credit histories; a solid score may give you an edge in securing your dream apartment. Job opportunities might also improve since some employers review candidates’ financial backgrounds. A good score could reflect responsibility and reliability, traits highly valued in potential employees. With Kovo Credit’s personalized strategies, these new avenues become accessible faster than expected. Unlocking such opportunities is not just about numbers—it’s about building a brighter future.