Are you tired of traditional banks offering meager interest rates on your savings? Or perhaps you’re a borrower looking for more flexible options without the red tape of conventional lending? Zonky is a peer-to-peer lending platform that promises to connect investors and borrowers in a way that could redefine your financial experience. But does it live up to the hype? In this comprehensive Zonky review, we’ll explore its features, benefits, and potential drawbacks to help you decide whether this innovative platform is truly worth your investment or if it is just another digital illusion in the vast world of finance.

Introduction to Zonky and Peer-to-Peer Lending

Peer-to-peer lending is transforming the way people think about investing. No longer is it necessary to rely only on traditional banks to grow your money. Zonky offers a platform that connects individual investors with borrowers seeking loans, and what sets it apart in this competitive space is its user-friendly interface and innovative design. The platform not only promises potential financial returns but also provides an opportunity for investors to make a difference by directly supporting individuals. For anyone curious about how Zonky functions and whether it is worth their time and money, a closer look at its operations can provide useful insights.

How Zonky Works

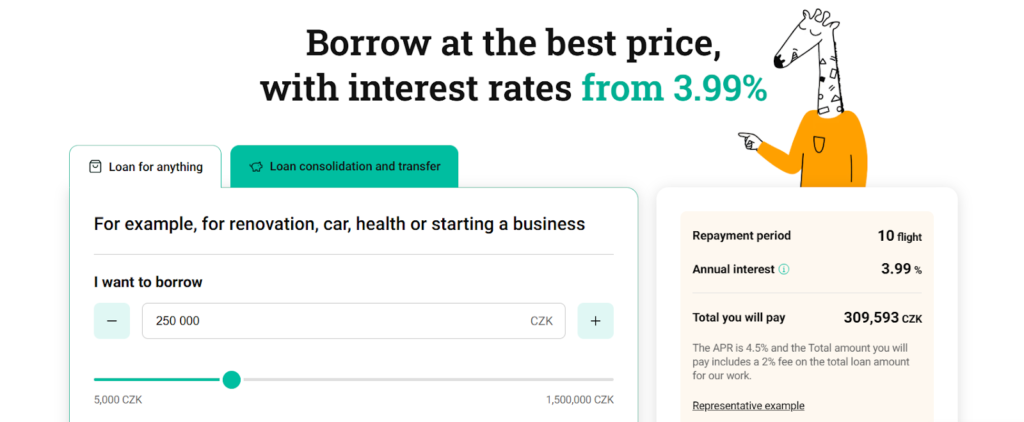

Zonky operates by connecting investors directly with borrowers, creating an active peer-to-peer lending marketplace. The process begins when borrowers submit loan applications through the platform, which are then carefully assessed to determine their creditworthiness. Once a loan is approved, it is listed on the marketplace where investors can browse and select opportunities based on risk level and projected returns. Investors can decide how much they want to contribute to each loan, transferring funds into Zonky’s system where the money is pooled with other investors’ contributions to provide the borrower with the necessary amount. Repayments begin once the borrower receives the loan, and investors start receiving monthly payments consisting of both principal and interest. These can be easily tracked using Zonky’s dashboard, which is designed to keep the process simple and transparent.

Safety and Security Measures

Zonky places a strong emphasis on protecting the interests of both investors and borrowers. It uses advanced encryption technology to ensure that sensitive data remains secure during transactions. To minimize risk, the platform has developed a sophisticated credit scoring system that evaluates each borrower’s reliability before a loan is approved. This system allows investors to review detailed profiles and make informed decisions. Zonky also maintains a reserve fund designed to compensate investors in the event of borrower defaults, offering an added layer of reassurance. In addition to these measures, the platform undergoes regular audits to remain compliant with financial regulations, further building trust among its users. Investors are also encouraged to activate two-factor authentication for extra security, ensuring that their accounts remain protected against unauthorized access.

Reviews from Investors

Feedback from investors provides a mixed but valuable perspective on Zonky. Many highlight the platform’s ease of use, noting that its straightforward design makes it accessible for both beginners and experienced investors. Positive reviews often focus on the potential for attractive returns, as well as the ability to select specific loans that align with personal values or preferred levels of risk. On the other hand, some investors have raised concerns about the rate of borrower defaults, which can create uncertainty regarding the security of their investments and the consistency of expected returns. Opinions about customer service are also divided. While certain users find the support team responsive and helpful, others believe there is room for improvement in how inquiries are handled. Overall, the feedback portrays a platform with promise but also one that comes with certain risks and challenges.

Tips for Investing Successfully

Investing on Zonky requires a thoughtful approach in order to reduce risks and maximize returns. Many investors find it helpful to spread their investments across different loans rather than putting large amounts into just one. Taking the time to carefully evaluate borrower profiles can also make a difference, especially when focusing on individuals with strong credit histories and steady incomes. Setting a clear investment budget is another way to maintain financial control while still allowing your money to grow gradually. Staying informed about any updates or changes to the platform is equally important, as new features or adjustments may influence investment strategies. Regularly reviewing how your investments are performing can help you adapt your approach and improve your chances of long-term success.

Alternatives to Zonky

While Zonky presents an appealing option, it may not suit every investor’s needs. Other peer-to-peer lending platforms also provide interesting opportunities. Mintos is a popular choice, offering a wide variety of loans from different countries that allow investors to diversify easily. Bondora emphasizes simplicity and user experience, making it attractive for both beginners and seasoned investors thanks to its automated investing features. For those interested in UK-based platforms, Funding Circle is well-regarded for facilitating loans to small businesses, allowing investors to support entrepreneurs while pursuing financial returns. PeerBerry is another alternative, known for its strong performance history and range of loan types with flexible terms that cater to different levels of risk appetite. These options demonstrate that the peer-to-peer lending market is rich with opportunities beyond Zonky.

Conclusion

Choosing the right platform for investing is an important decision, and Zonky offers a unique option within the peer-to-peer lending space. With its intuitive design and transparent processes, it appeals to both new and experienced investors. The potential for good returns is certainly present, but as with any investment, risks remain. Zonky’s safety measures and reserve fund provide some degree of protection, though they cannot eliminate risks entirely. Reviews from current and past investors highlight both successes and challenges, which serve as a reminder that careful consideration is essential before committing funds. For those who want to explore alternatives, several other platforms offer different features and advantages depending on individual goals. Ultimately, whether Zonky is worth the investment depends on your personal circumstances, financial objectives, and risk tolerance. Conducting thorough research and, if necessary, diversifying across platforms may provide the best path toward a balanced and rewarding investment experience.